Economic Development

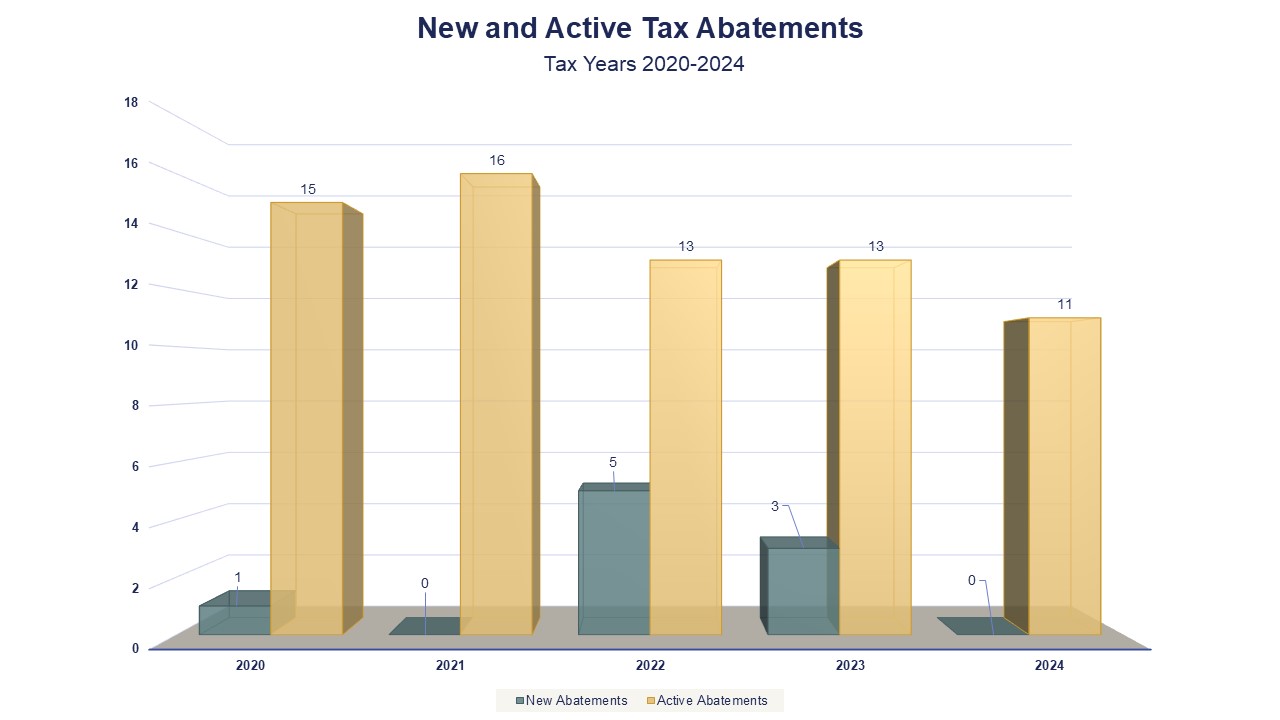

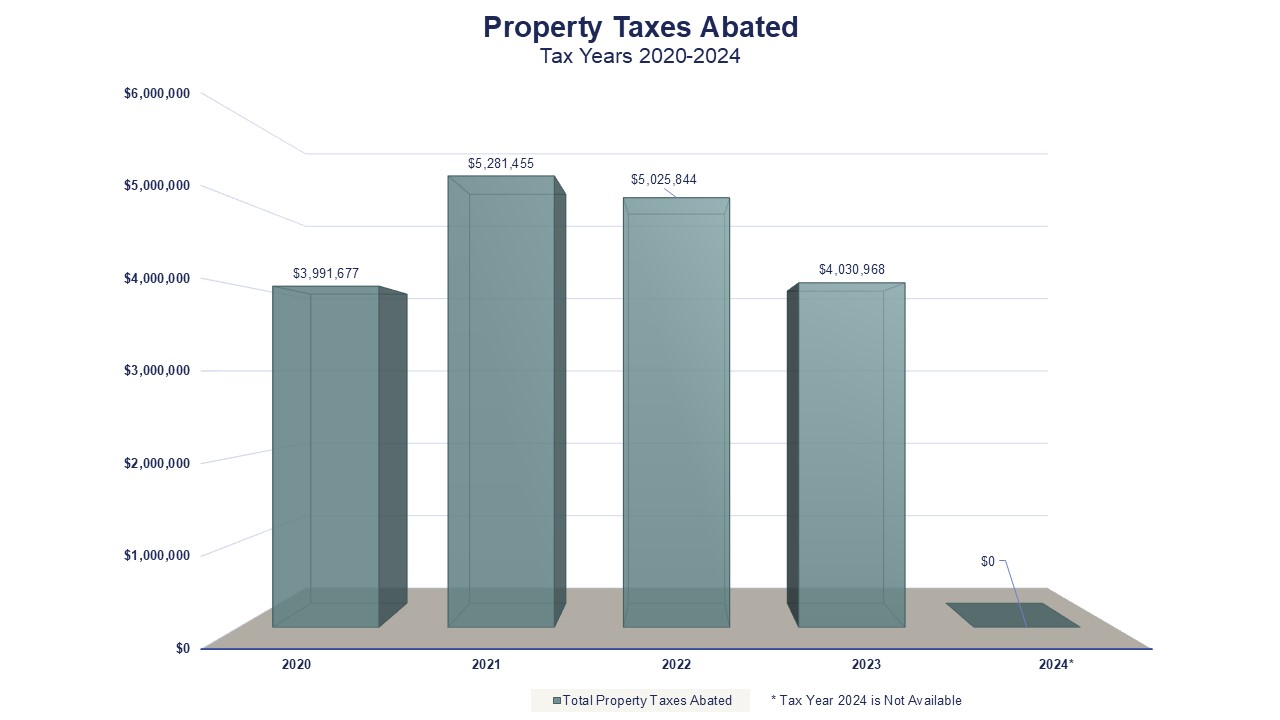

Tarrant County works in partnership with local municipalities and other taxing authorities to offer tax abatements as part of an overall publicly supported incentive program. Since 1989, it is estimated that the County has received approximately $9.21 billion in capital investment through the program. The program is designed to create job opportunities that bring new economic advantages or strengthen the current economic base of our community. As prescribed in Chapter 312 of the Texas Tax Code, the Commissioners Court of Tarrant County considers each request for tax abatement on a case by case basis, in accordance with the County’s Tax Abatement Policy. The offer of incentives is tied to an analysis of the economic impact of the project on the community, including the amount of investment in real and personal property; the number, types and salaries of new and retained jobs; the provision of health and other benefits by the company; and other project specific factors. In 2024, no new tax abatements were approved. Approximately 13,910 jobs were created or retained through the tax abatement program.

In addition to tax abatement, Tarrant County also participates with the local municipalities in Tax Increment Financing; the nomination of projects as Enterprise Projects; Foreign Trade Zone designation for applicable companies; assistance with roadway or site access improvements; and the recently established PACE Program for the County. Additional information on these programs can be found on the Tarrant County Economic Development webpage.

Below are visual aids that show the number of new and active tax abatements for Tax Years 2020-2024 and the total property taxes abated for Tax Years 2020-2024.

Accessibility Notice: Due to the complexity of the source documents, the documents on this page were created from images. If you require assistance in accessing the information, please contact (817) 884-1267.

TARRANT COUNTY, TX

TARRANT COUNTY, TX

OpenBooks

OpenBooks