Public Pension

Tarrant County is part of the Texas County and District Retirement System (TCDRS). TCDRS membership includes nearly 870 counties and districts with over 380,000 members and retirees. While the County is a part of TCDRS, the Tarrant County Commissioners Court defines the benefit plan for county employees and retirees.

The basic plan options include:

Employee Deposit Rate |

7% |

Employer Matching |

200% |

A county employee is eligible for retirement if any of the following criteria are met:

Vested at Age 60 |

8 years of full-time service |

Rule of 75 |

75 points = age + years of service |

At Any Age |

30 years of service |

See the actuarial information for the County below:

Plan Assets and Liabilities (In Thousands) |

|

Actuarial Accrued Liability (AAL) |

$2,360,814 |

Actuarial Value of Assets (AVA) |

$2,167,154 |

Unfunded Actuarial Accrued Liability (UAAL) |

$193,660 |

Funded Ratio (AVA/AAL) |

91.80% |

Remaining Amortization Period |

4 years |

Assumed Rate of Return |

7.50% |

Valuation Payroll |

$357,315 |

UAAL as a Percent of Covered Payroll |

54.20% |

Actuarial Methodology |

|

Actuarial Cost |

Entry age |

Amortization Method |

Level percentage of payroll, closed |

Remaining Amortization Period |

4 years* |

Asset Valuation Method |

5 year smoothed fair value |

Inflation |

2.5% |

Salary Increase Average** |

4.7% over career |

Investment Rate of Return*** |

7.5% |

Average Age at Service Retirement for Recent Retirees**** |

61 |

*Based on contribution rate calculated in Dec. 31, 2023 valuation. **Varies by age and service. Includes inflation. *** Net of investment expenses, including inflation. ****Retirement age members who are eligible for service retirement are assumed to commence receiving benefit payments based on age.

Investment Rates of Return for Previous Years |

|

2023 |

7.5% |

2022 |

7.5% |

2021 |

7.6% |

2020 |

8.1% |

2019 |

8.1% |

2018 |

8.1% |

2017 |

8.1% |

2016 |

8.1% |

2015 |

8.1% |

2014 |

7.75% |

2013 |

8% |

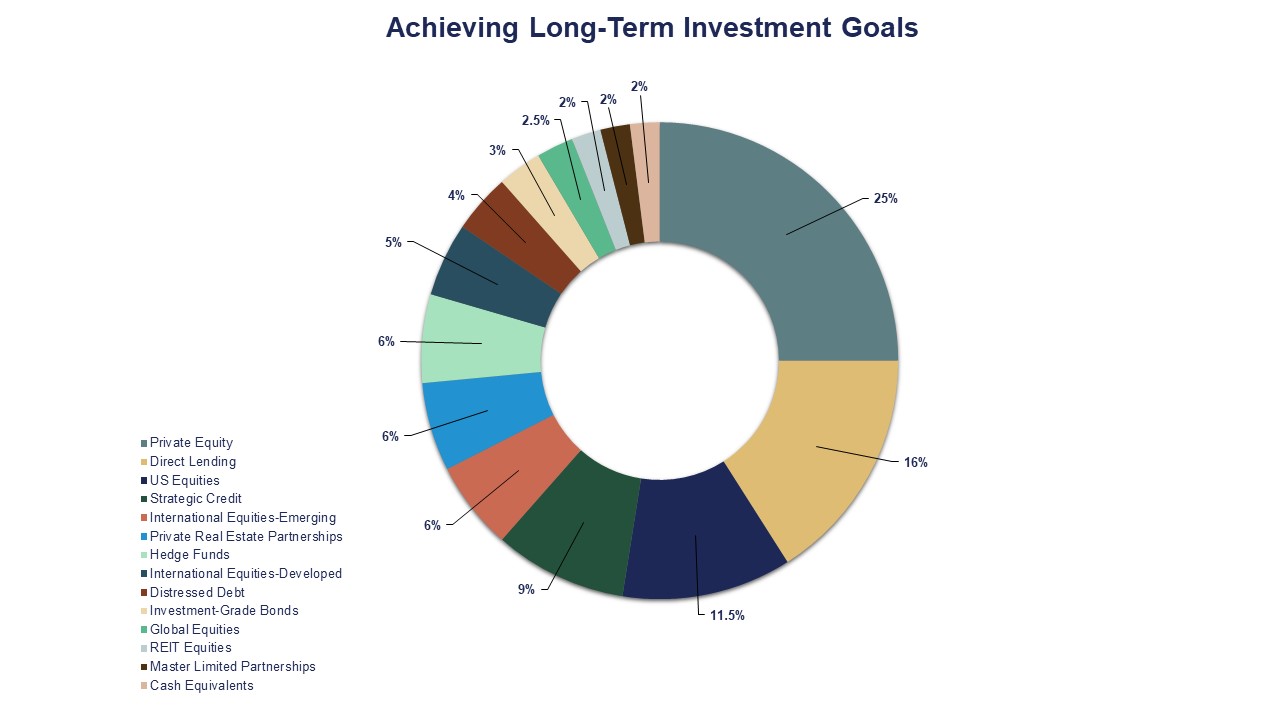

Chart 1: Achieving Long-Term Investment Goals

To help mitigate risk, Tarrant County Commissioners Court works closely with TCDRS to ensure the County’s retirement plan entails a diversified portfolio. As of March 2024, the County’s asset allocation included the following:

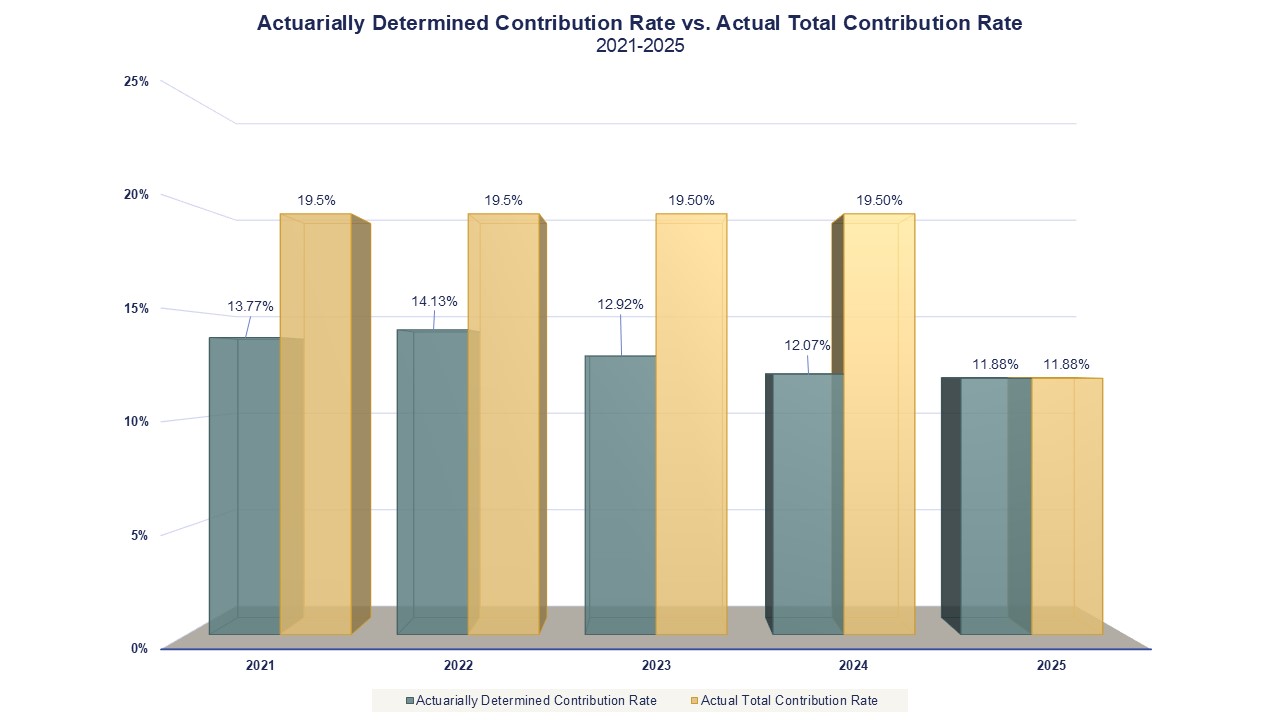

Actuarially Determined Contribution Rate versus the Actual Total Contribution Rate for Tarrant County

For 2025, Tarrant County Commissioners Court elected to use the Actually Determined Contribution Rate of 11.88 percent of payroll as determined by TCDRS. The Total Contribution Rate of 11.88 percent of payroll will go towards funding the County’s retirement plan.

Below Chart 2 compares the Actuarially Determined Contribution Rates versus Tarrant County's Actual Total Contribution Rates. Over the last four years, Tarrant County Commissioners Court has continued to pay above the required amount to pay down the unfunded liability.

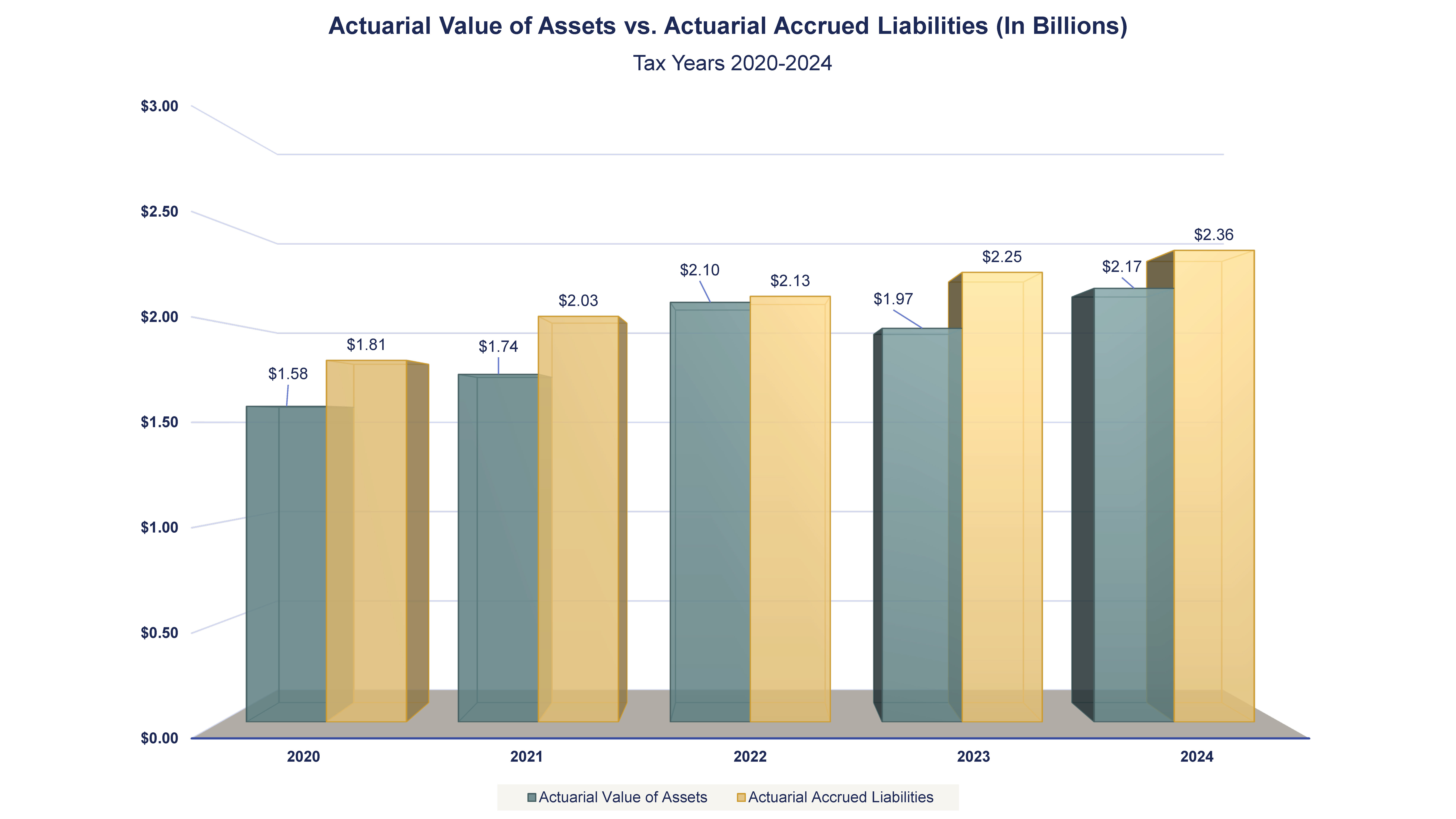

Chart 3 shows the five year history of Tarrant County's Actuarial Value of Assets versus Actuarial Accrued Liabilities. This data can be found in the Tarrant County Comprehensive Annual Financial Report. Chart 3 does not include the Community Supervision and Corrections Department actuarial valuation results.

TARRANT COUNTY, TX

TARRANT COUNTY, TX

OpenBooks

OpenBooks